Catastrophe Adjuster Provider for Rapid Claims Resolutions

Catastrophe Adjuster Provider for Rapid Claims Resolutions

Blog Article

How a Catastrophe Insurer Can Maximize Your Insurance Coverage Insurance Claim

Browsing the intricacies of an insurance claim complying with a catastrophe can be overwhelming, especially when trying to guarantee a fair settlement. A catastrophe adjuster has the knowledge to enhance this process, providing valuable understandings that can considerably boost your case's end result. From carrying out in-depth assessments to promoting for your legal rights, their role is pivotal in mitigating the stress connected with claims monitoring (catastrophic claims adjuster). Recognizing the full extent of their abilities and how they can work to your advantage is critical-- there are necessary elements that can make all the difference in your claim experience.

Understanding Catastrophe Insurers

Catastrophe insurance adjusters play a crucial role in the insurance policy claims process, specifically in the consequences of considerable calamities. These professionals focus on analyzing damages arising from disastrous occasions such as hurricanes, floodings, fires, and earthquakes. Their experience is important for properly assessing the degree of losses and establishing suitable compensation for insurance policy holders.

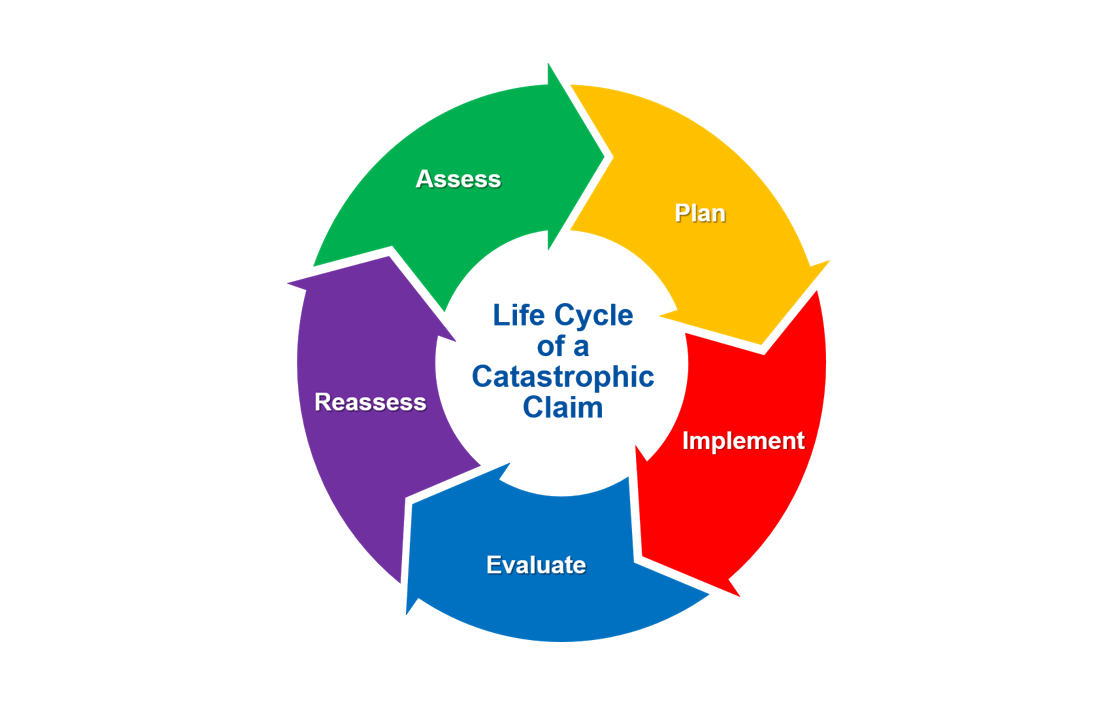

A disaster adjuster usually has customized training and experience in disaster-related claims, allowing them to navigate the intricacies of insurance plan and neighborhood policies. They conduct complete evaluations of damaged homes, compile in-depth records, and gather supporting documentation to corroborate insurance claims. This process often includes working very closely with policyholders, service providers, and various other stakeholders to guarantee a detailed assessment is finished.

In enhancement to reviewing physical damages, catastrophe insurance adjusters also take into consideration the economic and psychological impact on affected individuals, supplying advice throughout the cases procedure. Their objective perspective assists keep justness and openness, ensuring that policyholders obtain the advantages they are entitled to under their insurance coverage - catastrophic insurance adjuster. Comprehending the role of disaster insurers is crucial for insurance holders seeking to optimize their cases, as their know-how can substantially influence the outcome of the cases process

Advantages of Working With a Disaster Adjuster

Working with a catastrophe insurer can offer substantial benefits for policyholders browsing the claims procedure after a disaster. These experts concentrate on evaluating problems from devastating occasions, ensuring that the examination is exact and extensive. Their expertise enables a detailed understanding of the intricacies associated with insurance policy cases, which can usually be frustrating for insurance policy holders.

One of the key benefits of hiring a catastrophe insurer is their ability to make best use of claim settlements. Their understanding of market criteria and techniques allows them to support effectively in support of the insurance policy holder, making certain that all qualified problems are recorded and valued suitably. This campaigning for can lead to higher economic recuperation than what a policyholder might achieve on their own.

In addition, catastrophe insurance adjusters bring neutrality to the claims procedure. They are not psychologically purchased the after-effects of the disaster, enabling them to analyze damages right. Their experience in working out with insurance coverage firms can expedite the claims process, lessening delays that commonly take place when policyholders deal with insurance claims separately.

Eventually, involving a disaster insurer can relieve the burden of navigating a complex insurance landscape, offering comfort during a tough time.

The Claims Process Described

After your claim is submitted, an insurance policy adjuster, usually a catastrophe insurance adjuster in extreme cases, will be appointed to assess the damage. This specialist will assess the degree of the loss, assess your policy for protection, and establish the appropriate payment. It is very important to record the damage thoroughly, including pictures and a thorough inventory of shed or damaged items.

When the insurer's analysis is complete, they will submit a report to the insurance coverage business. The insurance firm will certainly after that review the claim and communicate their choice regarding the payout. If authorized, you will certainly obtain settlement based wikipedia reference upon the regards to your plan. Throughout this procedure, preserving clear interaction with your insurance adjuster and comprehending your plan will substantially improve your capability to navigate the insurance claims process efficiently.

Typical Mistakes to Avoid

Browsing the insurance coverage claims procedure can be difficult, and preventing common challenges is necessary for maximizing your payout - catastrophic insurance adjuster. One common mistake is falling short to document problems completely. Without proper proof, such as photographs and thorough descriptions, it becomes hard to validate your claim. Furthermore, overlooking to maintain records of all interactions with your insurance provider can lead to misconceptions and complications down the line.

One more usual error is undervaluing the timeline for suing. Several plans have strict due dates, and hold-ups can result in denial. Some claimants may accept the very first negotiation deal without negotiating. Initial offers commonly drop brief of full compensation, so it's important to examine the complete level of your losses prior to concurring.

In addition, neglecting policy information can impede your claim. A disaster adjuster can give vital support, ensuring that you stay clear of these mistakes and browse the insurance claims procedure successfully.

Choosing the Right Insurer

When it concerns optimizing your insurance coverage case, choosing the appropriate insurance adjuster is a critical action in the process. The insurance adjuster you pick can substantially affect the result of your case, influencing both the rate of resolution find out here now and the quantity you get.

Following, consider their track record. Seek reviews or reviews from previous clients to gauge their integrity and performance. A great insurance adjuster ought to interact plainly and supply regular updates on Resources the progress of your case.

Final Thought

In final thought, engaging a disaster insurer can substantially improve the potential for a desirable insurance policy claim outcome. Their expertise in browsing complicated plans, carrying out complete examinations, and successfully working out with insurer ensures that insurance holders get fair payment for their losses. By avoiding usual mistakes and leveraging the insurer's specialized understanding, people can optimize their claims and ease the concerns connected with the claims procedure, ultimately bring about a more sufficient resolution in the consequences of a calamity.

Catastrophe insurers play an essential function in the insurance declares procedure, particularly in the consequences of substantial disasters. Comprehending the duty of catastrophe insurance adjusters is crucial for policyholders seeking to optimize their cases, as their knowledge can dramatically affect the outcome of the insurance claims procedure.

Their experience in bargaining with insurance companies can accelerate the cases procedure, minimizing delays that commonly take place when insurance holders handle claims separately.

After your insurance claim is submitted, an insurance policy insurer, often a catastrophe adjuster in severe cases, will be assigned to evaluate the damage. By avoiding common pitfalls and leveraging the adjuster's specialized knowledge, individuals can optimize their cases and ease the problems connected with the insurance claims process, eventually leading to a much more satisfying resolution in the after-effects of a catastrophe.

Report this page